Multiple Choice

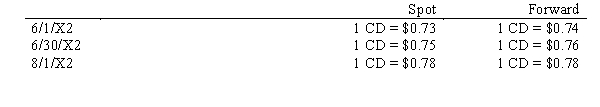

On 6/1/X2, an American firm purchased a inventory costing 100,000 Canadian Dollars from a Canadian firm to be paid for on 8/1/X2. Also on 6/1/X2, the American firm entered into a forward contract to purchase 100,000 Canadian dollars for delivery on 8/1/X2. The exchange rates were as follows:  The American firm's fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%. The transaction qualifies as for accounting as a cash flow hedge. What is the total amount that will be recognized in other comprehensive income in the year ended 6/30/X2?

The American firm's fiscal year end is 6/30/X2. The changes in the value of the forward contract should be discounted at 8%. The transaction qualifies as for accounting as a cash flow hedge. What is the total amount that will be recognized in other comprehensive income in the year ended 6/30/X2?

A) $1,987 debit

B) $2,320 credit

C) $320 credit

D) $2,000 debit

Correct Answer:

Verified

Correct Answer:

Verified

Q11: On 6/1/X2, an American firm purchased a

Q12: A United States based company that has

Q17: On November 1, 20X1, a U.S. company

Q19: A derivative:<br>A)requires little or no initial investment.<br>B)derives

Q32: In a credit transaction resulting in an

Q39: Which of the following does not represent

Q51: Which of the following statements is not

Q58: Which of the following factors influences the

Q73: Gains and losses resulting from a derivative

Q75: In the accounting for forward exchange contracts,