Essay

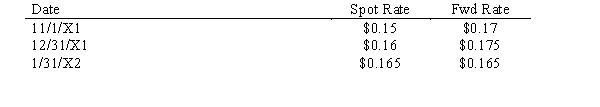

On November 1, 20X1, a U.S. company sold merchandise to a foreign firm for 100,000 FC with payment to be made on January 31, 20X2, in FC. To hedge against fluctuations in exchange rates, the firm also entered into a forward exchange contract on November 1, 20X1 to sell 100,000 FC on January 31, 20X2. The U.S. firm has a December 31 year end for accounting purposes. The following exchange rates may apply:

Discount rate = 10%

Required:

Make all the necessary journal entries for the U.S. firm relative to these events occurring between November 1, 20X1, and January 31, 20X2.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A United States based company that has

Q14: On 6/1/X2, an American firm purchased a

Q20: Wolters Corporation is a U.S. corporation that

Q22: On January 1, 20X1, a domestic firm

Q30: Which of the following statements is true

Q32: In a credit transaction resulting in an

Q39: Which of the following does not represent

Q58: Which of the following factors influences the

Q73: Gains and losses resulting from a derivative

Q75: In the accounting for forward exchange contracts,