Short Answer

On January 1, 20X1, Paul, Inc. acquired a 90% interest in Stephan Company. The $45,000 excess of purchase price (parent's share only) was attributable to goodwill. On January 1, 20X3, Stephan Company had the following stockholders' equity:  On January 2, 20X3, Stephan sold 2,000 additional shares in a private offering. Stephan issued the new shares for $80 per share; Paul, Inc. purchased all the shares. What is the journal entry that Paul will prepare to record this investment?

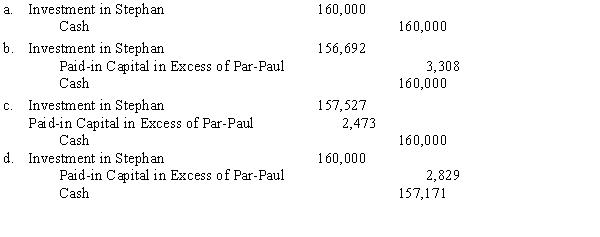

On January 2, 20X3, Stephan sold 2,000 additional shares in a private offering. Stephan issued the new shares for $80 per share; Paul, Inc. purchased all the shares. What is the journal entry that Paul will prepare to record this investment?

Correct Answer:

Verified

C

1 (9,000 + 2,000) ÷ (10,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

1 (9,000 + 2,000) ÷ (10,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: On January 1, 20X1, Parent Company purchased

Q15: On January 1, 20X1, Parent Company purchased

Q17: Company P had 300,000 shares of common

Q18: When a parent purchases a portion of

Q21: Parrot, Inc. purchased a 60% interest in

Q22: When a subsidiary purchases shares of the

Q25: Company P owns 80% of the 10,000

Q32: Which of the following situations is viewed

Q39: Able Company owns an 80% interest in

Q40: When a parent purchases a portion of