Essay

Parrot, Inc. purchased a 60% interest in Swallow Company on January 1, 20X1, for $204,000. Any excess of cost was attributable to goodwill.

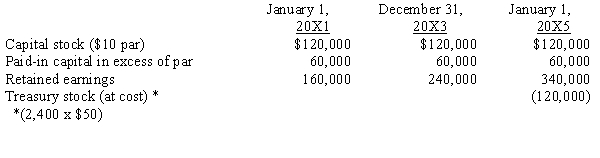

On January 1, 20X4, Swallow purchased 2,400 of its shares held by noncontrolling stockholders for $50 per share. Swallow equity balances on various dates were as follows:

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

Required:

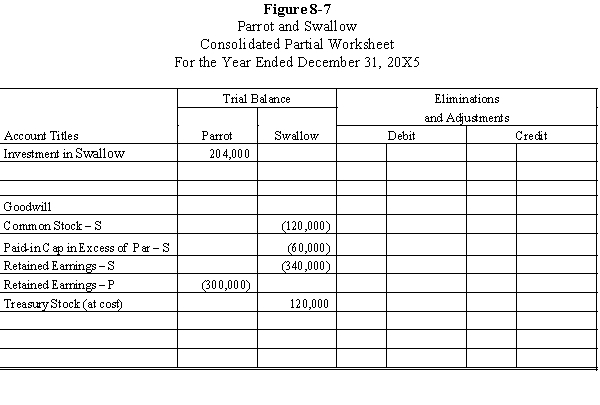

Prepare the necessary determination and distribution of excess schedules and all Figure 8-7 worksheet eliminations and adjustments on the following partial worksheet prepared on December 31, 20X5:

Correct Answer:

Verified

Determination and Distribution of Excess...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: On January 1, 20X1, Paul, Inc. acquired

Q18: When a parent purchases a portion of

Q21: Two types of intercompany stock purchases significantly

Q22: When a subsidiary purchases shares of the

Q23: On January 1, 20X1, Paul, Inc. acquired

Q24: On January 1, 20X1, Paris Ltd. paid

Q28: A owns 80% of B and 20%

Q32: Which of the following situations is viewed

Q39: Able Company owns an 80% interest in

Q40: When a parent purchases a portion of