The Following Consolidated Financial Statement Was Prepared Immediately Following the Acquisition

Essay

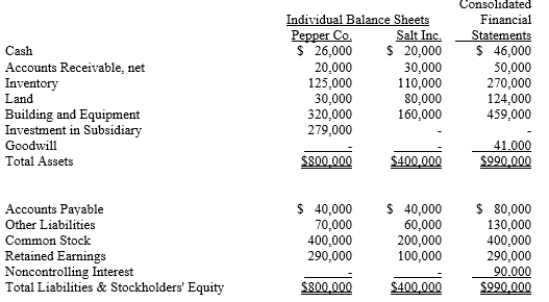

The following consolidated financial statement was prepared immediately following the acquisition of Salt, Inc. by Pepper Co.

Answer the following based upon the above financial statements:

a.How much did Pepper Co. pay to acquire Salt Inc.?

b.What was the fair value of Salt's Inventory at the time of acquisition?

c.Was the book value of Salt's Building and Equipment overvalued or undervalued relative to the Building and Equipment's fair value at the time of acquisition?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: How is the non-controlling interest treated in

Q4: Which of the following statements about consolidation

Q8: Pagach Company purchased 100% of the voting

Q9: On December 31, 20X1, Parent Company purchased

Q10: Fortuna Company issued 70,000 shares of $1

Q12: In an asset acquisition:<br>A)A consolidation must be

Q13: On April 1, 20X1, Paape Company paid

Q14: On April 1, 20X1, Paape Company paid

Q17: Consolidated financial statements are appropriate even without

Q22: Consolidated financial statements are designed to provide:<br>A)informative