Essay

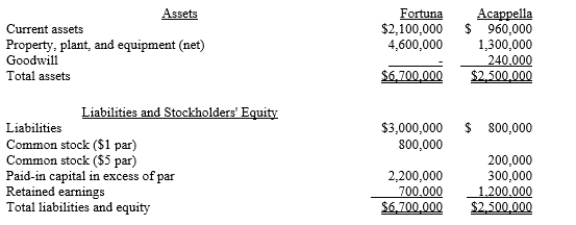

Fortuna Company issued 70,000 shares of $1 par stock, with a fair value of $20 per share, for 80% of the outstanding shares of Acappella Company. The firms had the following separate balance sheets prior to the acquisition:

Book values equal fair values for the assets and liabilities of Acappella Company, except for the property, plant, and equipment, which has a fair value of $1,600,000.

Required:

a.Prepare a value analysis schedule

b.Prepare a determination and distribution of excess schedule.

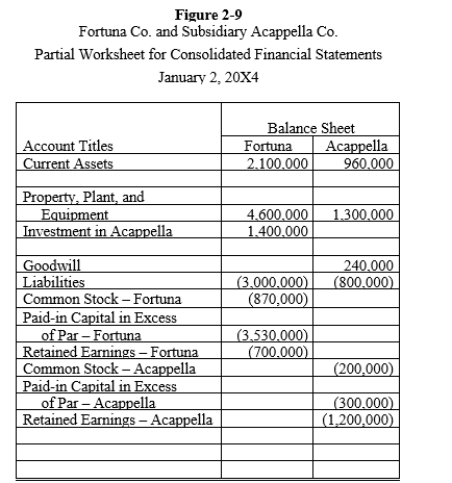

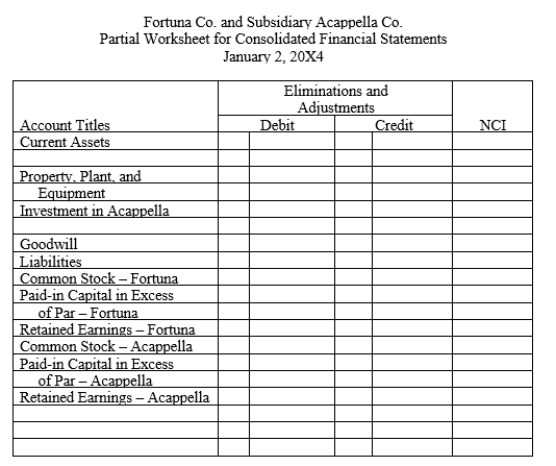

c.Provide all eliminations on the partial balance sheet worksheet provided in Figure 2-9 and complete the noncontrolling interest column.

Correct Answer:

Verified

a. Value analysis schedule:

*Cannot be...

*Cannot be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: How is the non-controlling interest treated in

Q4: Which of the following statements about consolidation

Q5: Supernova Company had the following summarized balance

Q8: Pagach Company purchased 100% of the voting

Q9: On December 31, 20X1, Parent Company purchased

Q11: The following consolidated financial statement was prepared

Q12: In an asset acquisition:<br>A)A consolidation must be

Q13: On April 1, 20X1, Paape Company paid

Q14: On April 1, 20X1, Paape Company paid

Q22: Consolidated financial statements are designed to provide:<br>A)informative