Multiple Choice

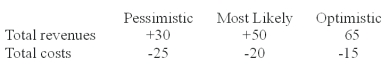

A project has an initial investment of $150. You have come up with the following estimates of revenues and costs. Calculate the NPV assuming that cash flow and perpetuities. (No taxes.) (Cost of capital = 10%)

A) 50, -100, +400

B) -50, +300, +500

C) -100, +150, +350

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Discounted cash-flow (DCF)analysis generally<br>I.assumes that firms hold

Q33: Postaudits are conducted before the start of

Q34: Hammer Company proposes to invest $6 million

Q35: You are planning to produce a new

Q36: Briefly describe sensitivity analysis used for project

Q37: Petroleum Inc. owns a lease to extract

Q39: You are given the following data for

Q41: Given the following net future values for

Q42: How do managers supplement the NPV analysis

Q43: Hammer Company proposes to invest $6 million