Multiple Choice

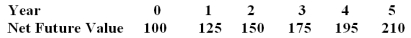

Given the following net future values for harvesting trees (one time harvest) : If the cost of capital is 15%, calculate the optimal year to harvest:

A) Year 1

B) Year 2

C) Year 3

D) Year 4

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Discounted cash-flow (DCF)analysis generally<br>I.assumes that firms hold

Q7: Briefly discuss the usefulness of Monte Carlo

Q36: Briefly describe sensitivity analysis used for project

Q37: Petroleum Inc. owns a lease to extract

Q38: A project has an initial investment of

Q39: You are given the following data for

Q42: How do managers supplement the NPV analysis

Q43: Hammer Company proposes to invest $6 million

Q44: Abandonment option is a call option, while

Q45: Which of the following simulation outputs is