Essay

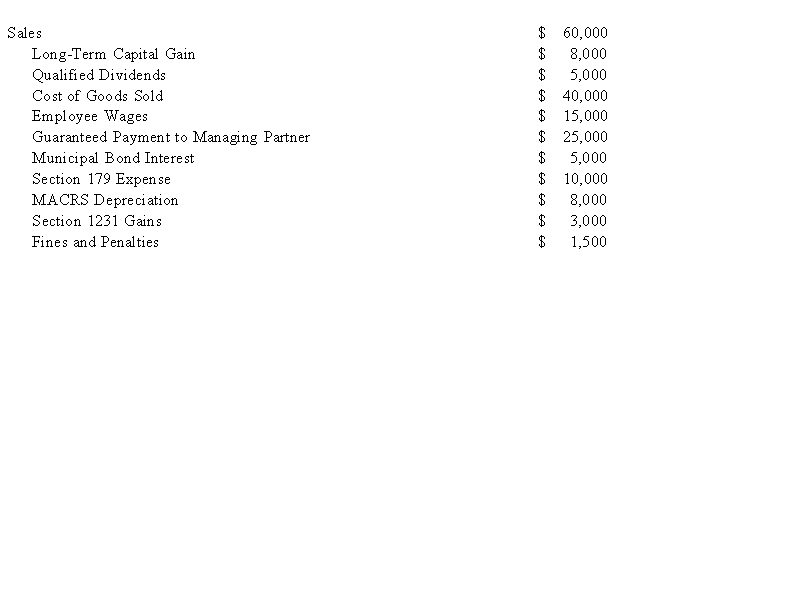

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:  Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Correct Answer:

Verified

($28,000),...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

($28,000),...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q29: The least aggregate deferral test uses the

Q42: Clint noticed that the Schedule K-1 he

Q43: Gerald received a one-third capital and profit

Q45: Which of the following would not be

Q46: If a taxpayer sells a passive activity

Q51: Which of the following items will affect

Q52: Lloyd and Harry, equal partners, form the

Q53: Tim, a real estate investor, Ken, a

Q77: A partner's outside basis must first be

Q113: Any losses that exceed the tax basis