Short Answer

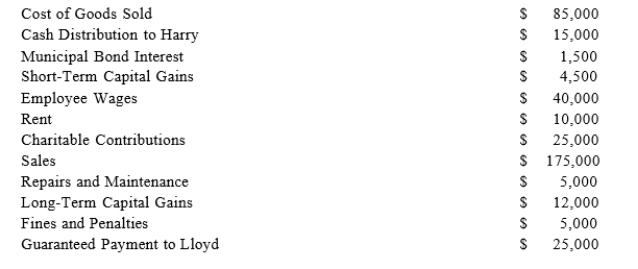

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the followin revenue, expenses, gains, losses, and distributions:  Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: The least aggregate deferral test uses the

Q42: Clint noticed that the Schedule K-1 he

Q48: Illuminating Light Partnership had the following revenues,

Q51: Which of the following items will affect

Q53: Tim, a real estate investor, Ken, a

Q54: Frank and Bob are equal members in

Q56: How does a partnership make a tax

Q57: Sarah, Sue, and AS Inc. formed a

Q67: A partner can generally apply passive activity

Q113: Any losses that exceed the tax basis