Essay

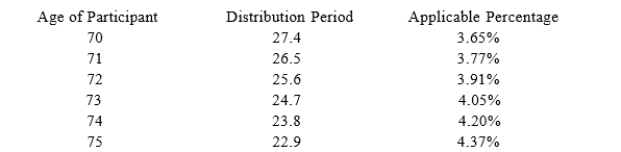

Sean (age 74 at end of 2017) retired five years ago. The balance in his 401(k) account on December 31, 2016 was $1,700,000 and the balance in his account on December 31, 2017 was $1,800,000. Using the IRS tables below, what is Sean's required minimum distribution for 2017?

Correct Answer:

Verified

For 2017, his required minimum distribut...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Joan recently started her career with PDEK

Q15: When employees contribute to a Roth 401(k)

Q16: Aiko (single, age 29) earned $40,000 in

Q17: Kathy is 48 years of age and

Q18: Which of the following is true concerning

Q21: Lisa, age 45, needed some cash so

Q23: Riley participates in his employer's 401(k) plan.

Q25: Which of the following statements regarding Roth

Q52: Yvette is a 44-year-old self-employed contractor (no

Q92: Employers may choose whom they allow to