Essay

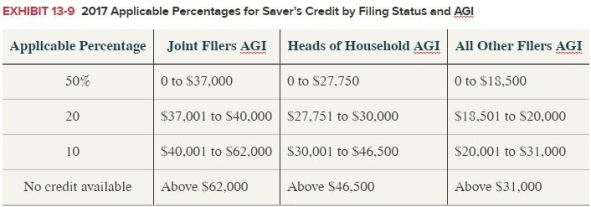

Aiko (single, age 29) earned $40,000 in 2017. He was able to contribute $1,800 ($150/month) to his employer sponsored 401(k). What is the total saver's credit that Aiko can claim for 2017? Exhibit13-9

Correct Answer:

Verified

$0

Single taxpayers ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$0

Single taxpayers ...

Single taxpayers ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q12: Kathy is 60 years of age and

Q13: Which of the following statements concerning nonqualified

Q14: Kathy is 60 years of age and

Q15: When employees contribute to a Roth 401(k)

Q17: Kathy is 48 years of age and

Q18: Which of the following is true concerning

Q20: Sean (age 74 at end of 2017)

Q21: Lisa, age 45, needed some cash so

Q52: Yvette is a 44-year-old self-employed contractor (no

Q80: Tatia, age 38, has made deductible contributions