Essay

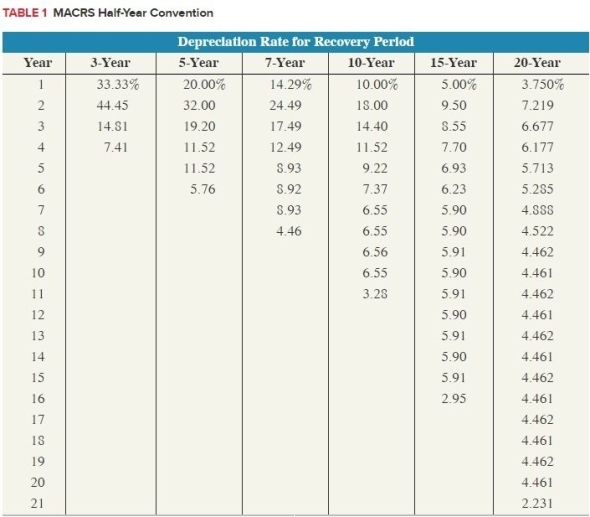

Bonnie Jo used two assets during the current year. The first was computer equipment with an original basis of $15,000, currently in the second year of depreciation, and under the half-yearconvention. This asset was disposed of on October 1st of the current year. The second was furniture with an original basis of $24,000 placed in service during the first quarter, currently in the fourth year of depreciation, and under the mid-quarter convention. What is Bonnie Jo's depreciationexpense for the current year? (Round final answer to the nearest whole number) (Use MACRSTable 1 and Table 2)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Assume that Yuri acquires a competitor's assets

Q5: Geithner LLC patented a process it developed

Q6: Boxer LLC has acquired various types of

Q9: Jorge purchased a copyright for use in

Q10: Eddie purchased only one asset during the

Q32: If a business mistakenly claims too little

Q82: Businesses deduct percentage depletion when they sell

Q107: Business assets that tend to be used

Q121: The basis for a personal-use asset converted

Q123: Taxpayers may always expense a portion of