Essay

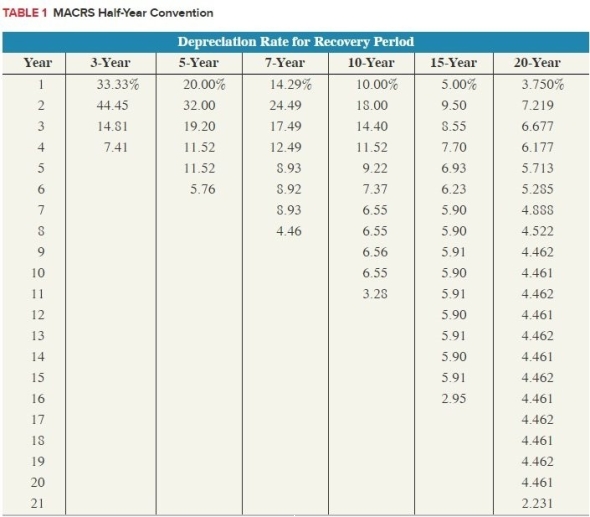

Reid acquired two assets in 2017: computer equipment (5-year property) acquired on August 6thwith a basis of $510,000 and machinery (7-year property) on November 9th with a basis of$510,000. Assume that Reid has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (but not bonus expensing). (Use MACRS Table 1)

Correct Answer:

Verified

$612,000

The $510,000 §179 expense shoul...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The $510,000 §179 expense shoul...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: depreciation). (Use MACRS Table 2 in the

Q37: Which of the following depreciation conventions are

Q38: Racine started a new business in the

Q39: Phyllis purchased $8,000 of specialized audio equipment

Q40: Daschle LLC completed some research and development

Q43: Which of the following is not usually

Q44: Tax cost recovery methods do not include:<br>A)

Q46: During April of the current year, Ronen

Q50: The §179 immediate expensing election phases out

Q80: Real property is always depreciated using the