Short Answer

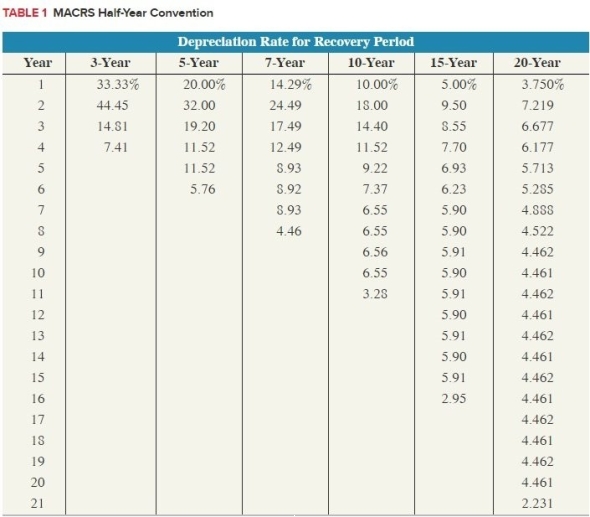

Phyllis purchased $8,000 of specialized audio equipment that she uses in her business regularly.Occasionally, she uses the equipment for personal use. During the first year, Phyllis used the equipment for business use 70 percent of the time; however, during the current (second) year the business use fell to 40 percent. Assume that the equipment is seven-year MACRS property and is under the half-year convention. Assume the ADS recovery period is 10 years. What is thedepreciation allowance for the current year? (Use MACRS Table 1) (Round final answer to thenearest whole number)

Correct Answer:

Verified

Phyllis mu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Assume that Bethany acquires a competitor's assets

Q36: depreciation). (Use MACRS Table 2 in the

Q37: Which of the following depreciation conventions are

Q38: Racine started a new business in the

Q40: Daschle LLC completed some research and development

Q41: Reid acquired two assets in 2017: computer

Q43: Which of the following is not usually

Q44: Tax cost recovery methods do not include:<br>A)

Q50: The §179 immediate expensing election phases out

Q80: Occasionally bonus depreciation is used as a