Multiple Choice

Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

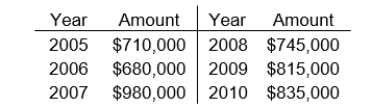

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-Estimated goodwill by capitalizing average excess earnings at 14% is

A) $1,791,667

B) $760,833

C) $2,029,762

D) $1,654,331

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The intangible asset goodwill may be<br>A) capitalized

Q42: The general ledger of Babcock Corporation as

Q43: Use the following information for questions <br>Jeremiah

Q44: Use the following information for questions <br>Jeremiah

Q45: Use the following information for questions <br>Jessup

Q46: Wriglee, Ltd.went to court this year and

Q47: Which of the following methods of amortization

Q48: On January 1, 2006, Robson Company purchased

Q49: Which of the following statements best describes

Q50: On June 30, 2010, Rock, Ltd.exchanged 3,000