Multiple Choice

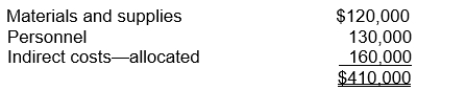

In 2010, Lawrence Corporation incurred development costs as follows:  These costs relate to a product that it expects to market in 2011.It is estimated that these costs will be recouped by December 31, 2013.What is the amount of development costs that could be deferred in 2010, assuming that required conditions for capitalization are met?

These costs relate to a product that it expects to market in 2011.It is estimated that these costs will be recouped by December 31, 2013.What is the amount of development costs that could be deferred in 2010, assuming that required conditions for capitalization are met?

A) $160,000.

B) $250,000.

C) $410,000.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: If a company constructs a laboratory building

Q4: Under private-entity GAAP, to determine if there

Q5: Use the following information for questions <br>Jessup

Q6: Use the following information for questions <br>Jessup

Q7: Use the following information for questions <br>Jessup

Q9: When determining whether an internally developed intangible

Q10: Which of the following legal fees should

Q11: Purchased goodwill should be<br>A)written off as soon

Q66: Negative goodwill arises when<br>A) the book value

Q82: The cost of purchasing patent rights for