Short Answer

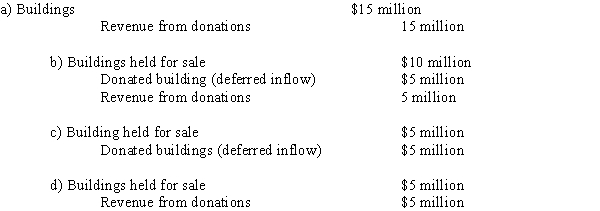

A wealthy philanthropist donates three buildings to H-Town.Each building has a fair market value of $5 million.The town plans to use Building 1 as a new fire station and sell Buildings 2 and 3. Building 2 is sold after year-end, but within the availability period.Building 3 fails to sell by the time the town issues the financial statements.Which of the following correctly records revenue from these donations in the governmental fund financial statements?

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Under the accrual basis of accounting used

Q12: A government is the recipient of a

Q13: The modified accrual basis of accounting is

Q13: Under the modified accrual basis of accounting,

Q14: Under the modified accrual basis of accounting,

Q16: Under the accrual basis of accounting, property

Q18: Paul City received payment of two grants

Q31: The budgetary measurement focus of governments is

Q47: If an entity elects to focus on

Q48: Under GAAP, property taxes levied in one