Short Answer

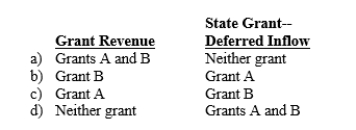

Paul City received payment of two grants from the state during its fiscal year ending September 30, 2013.Grant A can be used to cover any operating expenses incurred during fiscal 2014.Grant B can be used at any time to acquire equipment for the city's fire department.Should the city report these grants as grant revenues or deferred inflows in its governmental fund financial statements for fiscal 2013?

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Under the accrual basis of accounting, gains

Q13: Under the modified accrual basis of accounting,

Q13: The modified accrual basis of accounting is

Q14: Under the modified accrual basis of accounting,

Q15: A wealthy philanthropist donates three buildings to

Q16: Under the accrual basis of accounting, property

Q23: Ideally, under the accrual basis of accounting,

Q29: Last year a city received notice of

Q31: The budgetary measurement focus of governments is

Q48: Under GAAP, property taxes levied in one