Multiple Choice

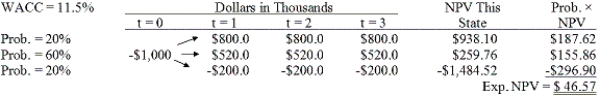

Brandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties.How much is the option to abandon worth to the firm?

A) $55.08

B) $57.98

C) $61.03

D) $64.08

E) $67.29

Correct Answer:

Verified

Correct Answer:

Verified

Q68: Estimating project cash flows is generally the

Q69: A firm is considering a new project

Q70: The primary advantage to using accelerated rather

Q71: In cash flow estimation, the existence of

Q72: Collins Inc.is investigating whether to develop a

Q73: Which one of the following would NOT

Q74: Fitzgerald Computers is considering a new

Q75: Which of the following procedures does the

Q76: Which of the following statements is CORRECT?<br>A)

Q77: Which of the following is NOT a