Multiple Choice

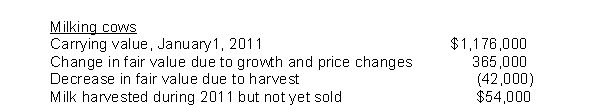

Dub Dairy produces milk to sell to local and national ice cream producers.Dub Dairy began operations on January 1, 2011 by purchasing 840 milk cows for $1,176,000.The company controller had the following information available at year end relating to the cows:  On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on biological assets will be reported?

On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on biological assets will be reported?

A) $ -0-

B) $365,000

C) $323,000

D) $54,600

Correct Answer:

Verified

Correct Answer:

Verified

Q8: If the contract price on a noncancelable

Q18: Why are inventories stated at lower-of-cost-or-net realizable

Q31: Under International Financial Reporting Standards (IFRS), a

Q32: Confectioners, a chain of candy stores, purchases

Q36: Lenny's Llamas purchased 1,500 llamas on January

Q37: In the retail inventory method, the term

Q39: The 2010 financial statements of Sito Company

Q45: Under International Financial Reporting Standards (IFRS), net

Q47: Use the following information for questions

Q49: Shake Company's inventory experienced a decline in