Multiple Choice

Use the following information for questions.

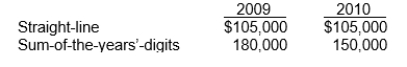

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

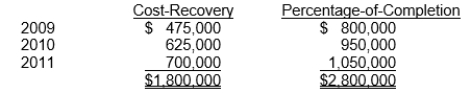

-During 2011, a construction company changed from the cost-recovery method to the percentage-of-completion method for accounting purposes but not for tax purposes.Gross profit figures under both methods for the past three years appear below:

Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

A) $600,000 on the 2011 income statement.

B) $390,000 on the 2011 income statement.

C) $600,000 on the 2011 retained earnings statement.

D) $390,000 on the 2011 retained earnings statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Under U.S.GAAP, the impracticality exception applies both

Q26: A change in accounting policy is a

Q29: The requirements for disclosure are the same

Q30: An income statement classification error has no

Q49: Which of the following is not treated

Q64: On December 31, 2011 Dean Company changed

Q65: Use the following information for questions.<br>Bishop Co.began

Q67: Use the following information for questions.<br>Ernst Company

Q69: Lanier Company began operations on January 1,

Q72: The ISAB is silent on the application