Multiple Choice

Use the following information for questions.

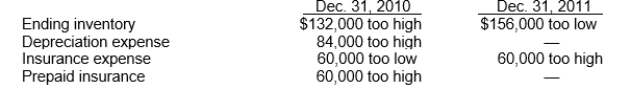

Bishop Co.began operations on January 1, 2010.Financial statements for 2010 and 2011 con- tained the following errors:

In addition, on December 31, 2011 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2012.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Bishop's 2011 net income is

A) understated by $376,800.

B) understated by $244,800.

C) overstated by $115,200.

D) overstated by $199,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Under U.S.GAAP, the impracticality exception applies both

Q26: A change in accounting policy is a

Q49: Which of the following is not treated

Q60: On January 1, 2009, Knapp Corporation acquired

Q61: Which of the following disclosures is not

Q62: On January 1, 2009, Neal Corporation acquired

Q64: On December 31, 2011 Dean Company changed

Q67: Use the following information for questions.<br>Ernst Company

Q68: Use the following information for questions.<br>Ventura Corporation

Q69: Lanier Company began operations on January 1,