Multiple Choice

Use the following information for questions.

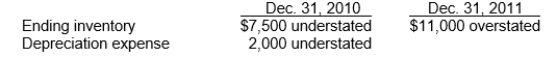

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on Langley's 2011 net income?

A) Net income understated by $14,500.

B) Net income overstated by $7,500.

C) Net income overstated by $13,000.

D) Net income overstated by $15,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A change in accounting policy is a

Q29: The requirements for disclosure are the same

Q30: An income statement classification error has no

Q35: When a company decides to switch from

Q68: Use the following information for questions.<br>Ventura Corporation

Q69: Lanier Company began operations on January 1,

Q72: The ISAB is silent on the application

Q74: Use the following information for questions.<br>On January

Q76: Heinz Company began operations on January 1,

Q77: Equipment was purchased at the beginning of