Multiple Choice

Use the following information for questions.

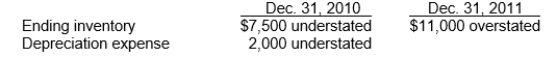

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-Accrued salaries payable of $51,000 were not recorded at December 31, 2010.Office supplies on hand of $24,000 at December 31, 2011 were erroneously treated as expense instead of supplies inventory.Neither of these errors was discovered nor corrected.The effect of these two errors would cause

A) 2011 net income to be understated $75,000 and December 31, 2011 retained earnings to be understated $24,000.

B) 2010 net income and December 31, 2010 retained earnings to be understated $51,000 each.

C) 2010 net income to be overstated $27,000 and 2011 net income to be understated $24,000.

D) 2011 net income and December 31, 2011 retained earnings to be understated $24,000 each.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Retrospective application refers to the application of

Q15: Which of the following statements is correct?<br>A)Changes

Q25: Adoption of a new policy in recognition

Q27: When it is impossible to determine whether

Q31: Use the following information for questions.<br>Ventura Corporation

Q32: Use the following information for questions.<br>Bishop Co.began

Q33: Use the following information for questions.<br>Link Co.purchased

Q38: An example of a correction of an

Q42: Errors in financial statements result from mathematical

Q47: Which type of accounting change should always