Multiple Choice

Use the following information for questions.

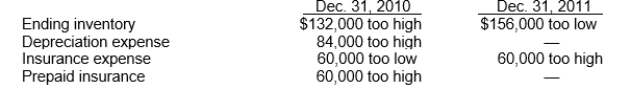

Bishop Co.began operations on January 1, 2010.Financial statements for 2010 and 2011 con- tained the following errors:

In addition, on December 31, 2011 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2012.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on the amount of Bishop's working capital at December 31, 2011 is understated by

A) $400,800.

B) $316,800.

C) $184,800.

D) $124,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The estimated life of a building that

Q25: Adoption of a new policy in recognition

Q30: Use the following information for questions.<br>On January

Q31: Use the following information for questions.<br>Ventura Corporation

Q33: Use the following information for questions.<br>Link Co.purchased

Q36: Use the following information for questions.<br>Langley Company's

Q42: Errors in financial statements result from mathematical

Q43: A company changes from straight-line to an

Q47: Which type of accounting change should always

Q48: Companies account for a change in depreciation