Multiple Choice

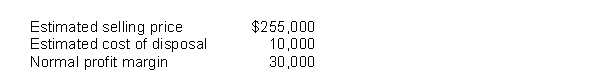

Washington Distribution Co.has determined its December 31, 2017 inventory on a FIFO basis at $240,000.Information pertaining to that inventory follows:  Washington records losses that result from applying the lower of cost and net realizable value rule.At December 31, 2017, the loss that Washington should recognize is

Washington records losses that result from applying the lower of cost and net realizable value rule.At December 31, 2017, the loss that Washington should recognize is

A) $0.

B) $5,000.

C) $15,000.

D) $25,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Conversion costs include<br>A) all materials plus direct

Q42: When using the moving-average cost formula with

Q109: Tehran Ltd.uses FIFO to cost its inventory.The

Q110: An inventory method which is designed to

Q111: The following inventory transactions took place for

Q112: To produce an inventory valuation which approximates

Q113: Which of the following does NOT correctly

Q117: Tennessee Ltd.'s accounting records reported the following

Q164: An inventory cost formula in which the

Q166: Which statement is NOT true about the