Multiple Choice

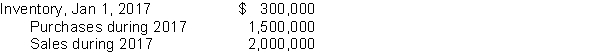

Tennessee Ltd.'s accounting records reported the following information:  A physical inventory taken on December 31, 2017 resulted in an ending inventory of $350,000.Tennessee's gross profit on sales has remained constant at 30% in recent years.Tennessee suspects some inventory may have been taken by a new employee.At December 31, 2017, what is the estimated cost of the missing inventory?

A physical inventory taken on December 31, 2017 resulted in an ending inventory of $350,000.Tennessee's gross profit on sales has remained constant at 30% in recent years.Tennessee suspects some inventory may have been taken by a new employee.At December 31, 2017, what is the estimated cost of the missing inventory?

A) $400,000

B) $100,000

C) $75,000

D) $50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Conversion costs include<br>A) all materials plus direct

Q42: When using the moving-average cost formula with

Q112: To produce an inventory valuation which approximates

Q113: Which of the following does NOT correctly

Q114: Washington Distribution Co.has determined its December 31,

Q120: The following information was reported by Montana

Q121: Which of the following items should be

Q139: If two factories produce the exact same

Q164: An inventory cost formula in which the

Q166: Which statement is NOT true about the