Multiple Choice

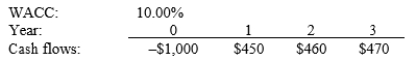

Adler Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected.

A) $142.37

B) $149.49

C) $156.97

D) $164.82

Correct Answer:

Verified

Correct Answer:

Verified

Q21: A company is choosing between two projects.The

Q29: Rappaport Enterprises is considering a project that

Q32: Babcock Inc. is considering a project that

Q33: Which of the following statements best describes

Q36: Which of the following statements is correct?

Q39: Anderson Associates is considering two mutually exclusive

Q56: Projects A and B are mutually exclusive

Q59: Project S has a pattern of high

Q74: Which of the following statements is correct?<br>A)The

Q84: Which of the following statements is correct?