Multiple Choice

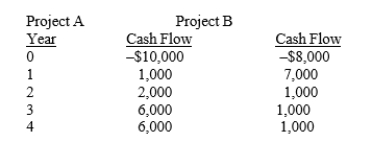

Anderson Associates is considering two mutually exclusive projects that have the following cash flows:  At what cost of capital do the two projects have the same NPV? (That is, what is the crossover rate?)

At what cost of capital do the two projects have the same NPV? (That is, what is the crossover rate?)

A) 11.20%

B) 12.26%

C) 13.03%

D) 14.15%

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The primary reason that the NPV method

Q4: A firm should never undertake an investment

Q34: Adler Enterprises is considering a project that

Q36: Which of the following statements is correct?

Q41: Which of the following statements is correct?

Q42: Projects A and B have identical expected

Q57: Which of the following statements is correct?

Q59: Project S has a pattern of high

Q74: Which of the following statements is correct?<br>A)The

Q84: Which of the following statements is correct?