Multiple Choice

Table 12-7

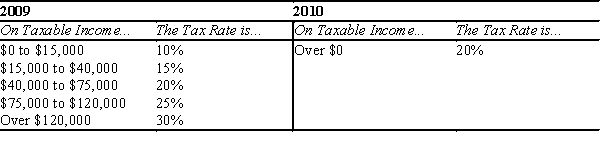

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-7. For an individual who earned $80,000 in both years, which of the following statements is true regarding the individual's marginal tax rate?

A) The marginal tax rate is higher in 2010 than in 2009.

B) The marginal tax rate is the same in 2010 as it was in 2009.

C) The marginal tax rate is lower in 2010 than in 2009.

D) With a proportional tax, as in 2010, it is not possible to determine the individual's marginal tax rate so it is not possible to compare the marginal tax rates in the two years.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Some colleges charge all students the same

Q101: With a lump-sum tax, the<br>A)marginal tax rate

Q131: The U.S. income tax<br>A)discourages saving.<br>B)encourages saving.<br>C)has no

Q152: Which of the following statements is correct?<br>A)Equity

Q285: Table 12-13<br>The table below provides information on

Q322: With a lump-sum tax,the average tax rate

Q323: Suppose Max values a concert ticket at

Q326: Table 12-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-11

Q329: Table 12-13<br>The table below provides information on

Q332: Tim earns income of $60,000 per year