Multiple Choice

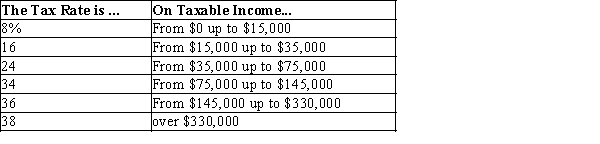

Table 12-11

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her tax liability is

A) $1,920.

B) $4,400.

C) $6,320.

D) $8,175.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Some colleges charge all students the same

Q101: With a lump-sum tax, the<br>A)marginal tax rate

Q131: The U.S. income tax<br>A)discourages saving.<br>B)encourages saving.<br>C)has no

Q152: Which of the following statements is correct?<br>A)Equity

Q285: Table 12-13<br>The table below provides information on

Q321: When taxes are imposed on a commodity,<br>A)there

Q322: With a lump-sum tax,the average tax rate

Q323: Suppose Max values a concert ticket at

Q327: Table 12-7<br>The following table shows the marginal

Q329: Table 12-13<br>The table below provides information on