Multiple Choice

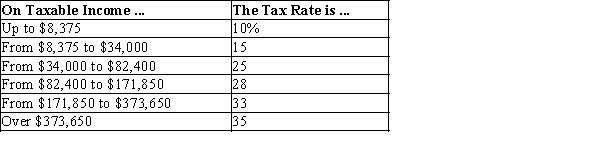

Table 12-10

-Refer to Table 12-10. If Willie has $170,000 in taxable income, his tax liability will be

A) $16,781.

B) $41,309.

C) $41,827.

D) $47,600.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: In 2014, the largest source of receipts

Q30: A payroll tax is also referred to

Q69: The marginal tax rate for a lump-sum

Q88: In the United States, the marginal tax

Q121: In order to determine tax incidence, one

Q147: Table 12-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-22

Q198: What are the two largest categories of

Q214: Which of the following statements is correct?<br>A)Both

Q475: Table 12-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-10

Q479: A tax imposed at every stage of