Multiple Choice

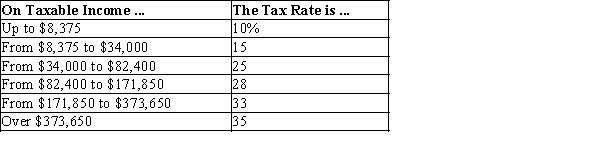

Table 12-10

-Refer to Table 12-10. If Willie has $170,000 in taxable income, his average tax rate is

A) 23.8%.

B) 24.3%.

C) 25.9%.

D) 28.0%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: In 2014, the largest source of receipts

Q30: A payroll tax is also referred to

Q69: The marginal tax rate for a lump-sum

Q121: In order to determine tax incidence, one

Q147: Table 12-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-22

Q198: What are the two largest categories of

Q214: Which of the following statements is correct?<br>A)Both

Q470: Table 12-23<br>The dollar amounts in the last

Q476: Table 12-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-10

Q479: A tax imposed at every stage of