Essay

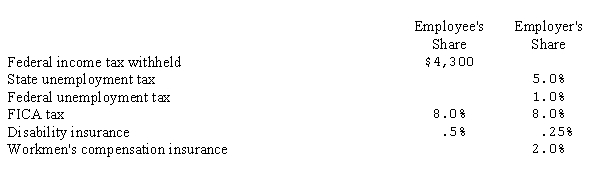

The following payroll summary is prepared for the Sothern Manufacturing Company for the week ending March 29:  Payroll taxes and insurance are to be computed as follows:

Payroll taxes and insurance are to be computed as follows:  Prepare the general journal entries to:

Prepare the general journal entries to:

a.Record the payroll.

b.Pay the payroll.

c.Distribute the payroll to the appropriate accounts.

d.Record the employer's share of payroll tax expense. (All of the employees work in the factory.)

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The file that serves as a basis

Q36: Idle time should be treated as follows:<br>A)It

Q37: Joel Williams works at Allentown Company where

Q38: The Dehl Company payroll for the first

Q40: The entry made in November to reverse

Q42: John Elton, who is classified as direct

Q43: Management of the Von Machine Company requests

Q44: Daktari Enterprises' Schedule of Earnings and Payroll

Q46: Becky Graham earns $15 per hour for

Q50: An analysis of total labor costs into