Short Answer

Use the following information for questions.

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $ 3,600 was prepaid in 2019 covering the calendar years 2019, 2020, and 2021. This had been debited to insurance expense. In addition, on December 31, 2020, fully depreciated machinery was sold for $ 1,900 cash, but the sale was not recorded until 2021. There were no other errors during 2020 or 2021 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $ 3,600 was prepaid in 2019 covering the calendar years 2019, 2020, and 2021. This had been debited to insurance expense. In addition, on December 31, 2020, fully depreciated machinery was sold for $ 1,900 cash, but the sale was not recorded until 2021. There were no other errors during 2020 or 2021 and no corrections have been made for any of the errors. Ignore income tax considerations.

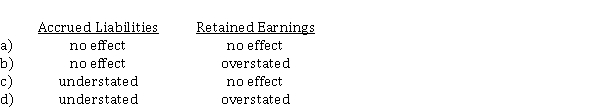

-On December 31, 2020, the bookkeeper at Thrush Corp. did not record special insurance costs that had been incurred (but not yet paid), related to a building that Thrush Corp. is constructing. What is the effect of the omission on accrued liabilities and retained earnings in the December 31, 2020 statement of financial position?

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Non-counterbalancing error correction<br>Turkey Corp. bought a machine

Q12: On January 1, 2020, Bluebird Ltd. changed

Q13: Effects of errors on financial statements<br>Show how

Q14: Use the following information for questions.<br>Cheyenne Ltd.'s

Q15: Change in estimate, voluntary change in accounting

Q17: Use the following information for questions.<br>Fairfax Inc.

Q18: Which of the following alternative accounting methods

Q19: Explain the circumstances in which an accounting

Q20: Retrospective application for accounting changes<br>Discuss how retrospective

Q21: Accounting for accounting changes and error corrections<br>Parrot