Multiple Choice

Use the following information for questions.

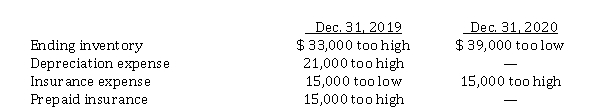

Fairfax Inc. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Fairfax's retained earnings at December 31, 2020 is that the balance is understated by

A) $ 82,200.

B) $ 67,200.

C) $ 46,200.

D) $ 34,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: On January 1, 2020, Bluebird Ltd. changed

Q13: Effects of errors on financial statements<br>Show how

Q14: Use the following information for questions.<br>Cheyenne Ltd.'s

Q15: Change in estimate, voluntary change in accounting

Q16: Use the following information for questions.<br>Cheyenne Ltd.'s

Q18: Which of the following alternative accounting methods

Q19: Explain the circumstances in which an accounting

Q20: Retrospective application for accounting changes<br>Discuss how retrospective

Q21: Accounting for accounting changes and error corrections<br>Parrot

Q22: Use the following information for questions.<br>Cheyenne Ltd.'s