Multiple Choice

Use the following information for questions 34-35.

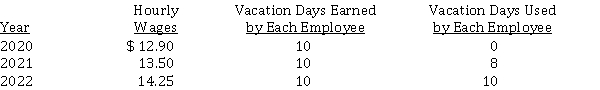

Silver Ltd. has 35 employees who work 8-hour days and are paid hourly. On January 1, 2020, the company began a program of granting its employees 10 days paid vacation each year. Vacation days earned in 2020 may be taken starting on January 1, 2021. Information relative to these employees is as follows:  Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

-What is the amount of vacation pay expense that should be reported on Silver's income statement for 2020?

A) $ 37,800

B) $ 36,120

C) $ 34,440

D) $ 0

Correct Answer:

Verified

Correct Answer:

Verified

Q75: Accounting for GST includes<br>A) crediting GST Payable

Q76: Compensated absences<br>Sycamore Ltd. began operations on January

Q77: The current (commonly used) accounting treatment for

Q78: The IASB issued a new Conceptual Framework

Q79: Which of the following is a current

Q81: Which of the following is generally associated

Q82: Contingent liabilities<br>Below are three independent situations:<br>1. In

Q83: On January 1, 2020, Wick Ltd., a

Q84: Under current IFRS requirements, a provision is

Q85: Under ASPE, an asset retirement obligation should