Short Answer

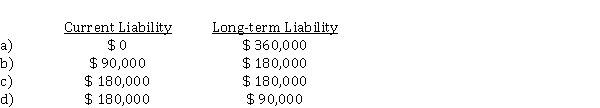

On January 1, 2020, Wick Ltd., a private company following ASPE leased a building to Candle Corp. for a ten-year term at an annual rental of $ 90,000. At the inception of the lease, Wick received $ 360,000 covering the first two years rent of $ 180,000 and a security deposit of $ 180,000. This deposit will NOT be returned to Candle upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the $ 360,000 should be shown as a current and long-term liability, respectively, in Wick's December 31, 2020 statement of financial position?

Correct Answer:

Verified

Correct Answer:

Verified

Q78: The IASB issued a new Conceptual Framework

Q79: Which of the following is a current

Q80: Use the following information for questions 34-35.<br>Silver

Q81: Which of the following is generally associated

Q82: Contingent liabilities<br>Below are three independent situations:<br>1. In

Q84: Under current IFRS requirements, a provision is

Q85: Under ASPE, an asset retirement obligation should

Q86: Notes payable<br>On August 31, 2020, Kamloops Corp.

Q87: Asbestos Corp. is being sued for illness

Q88: Presented below is information available for Radon