Multiple Choice

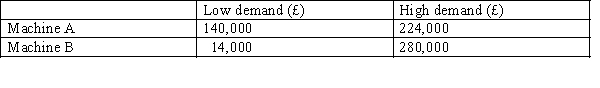

The Tamesek Company is considering purchasing one of two mutually exclusive machines. Machine A is most suited to low levels of demand whereas machine B is suited to high-level demand. There are only two possible outcomes and each has the same level of probability. The estimated profits for each demand level are as follows:  There is a possibility of employing a firm of management consultants who would be able to provide a perfect prediction of actual demand. What is the maximum amount that the company would be prepared to pay for the additional information?

There is a possibility of employing a firm of management consultants who would be able to provide a perfect prediction of actual demand. What is the maximum amount that the company would be prepared to pay for the additional information?

A) £98,000

B) £14,000

C) £70,000

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is NOT a

Q5: Which of the following is NOT a

Q7: The most likely outcome represents:<br>A)the expected value.<br>B)the

Q8: Which of the following assumptions apply when

Q9: Under what circumstances can risk reduction NOT

Q12: Figure 12-1<br>Joe Bloggs is considering the following

Q13: Sentosa Company is considering launching a new

Q14: Figure 12-2<br>ZX Company is faced with choosing

Q16: Figure 12-2<br>ZX Company is faced with choosing

Q20: Figure 12-3<br>The Lee Company must choose between