Multiple Choice

Figure 12-3

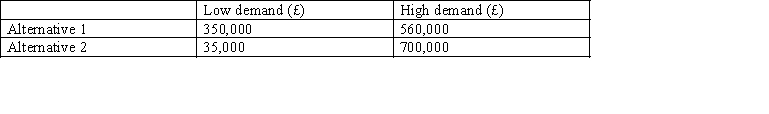

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:

-Refer to Figure 12-3 and assume that the probabilities of 0.5 for high and 0.5 for low demand are changed to 0.6 and 0.4 respectively. How would the change in probabilities change the values used to apply the maximax, maximin and regret criteria?

A) All of the values would increase.

B) All of the values would decrease.

C) Some values would increase and others would decrease.

D) The values would remain unchanged.

E) None of the above because it is not possible to apply any of the criteria from the data given.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following represent a tutor's estimate of

Q3: Which of the following is NOT a

Q5: Which of the following is NOT a

Q7: The most likely outcome represents:<br>A)the expected value.<br>B)the

Q8: Which of the following assumptions apply when

Q9: Under what circumstances can risk reduction NOT

Q10: Which of the following represent states of

Q15: The expected value represents:<br>A)the weighted average of

Q16: Figure 12-2<br>ZX Company is faced with choosing

Q17: The Tamesek Company is considering purchasing one