Multiple Choice

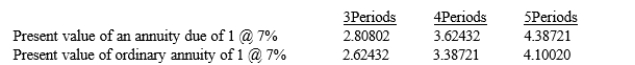

On January 1, 2016, Watson Company signed a four-year lease requiring annual payments of $45,000, with the first payment due on January 1, 2016. Watson's incremental borrowing rate was 7%. Actuarial information for 7% follows:

Assuming the lease qualifies as a capital lease, what amount should be recorded as leased equipment under capital leases on January 1, 2016 rounded to the nearest dollar) ?

A) $197,424

B) $163,094

C) $152,424

D) $184,509

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Which of the following items would not

Q40: Unlike in a direct-financing lease, the fair

Q41: On January 1, 2016, Denise Company signed

Q42: Which of the following cash flows is

Q44: Exhibit 20-3<br>On January 1, 2016, Quinn Company

Q46: On January 1, 2016, Donna Company leased

Q47: For a sales-type lease, cost of asset

Q48: A required disclosure of a direct financing

Q49: Which of the following items should be

Q50: Unlike in a direct-financing lease, the lessor