Multiple Choice

Exhibit 20-3

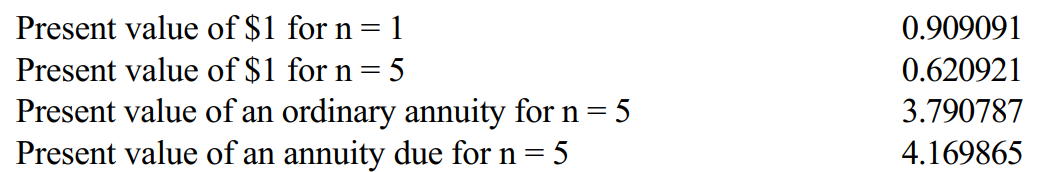

On January 1, 2016, Quinn Company enters into a five-year sales-type lease with Andy Company. The lease requires Andy to make five annual payments at the beginning of the year, with the first payment due January 1,2016. The lease includes a bargain purchase price of $10,000. Quinn requires a 10% rate of return. The cost to Quinn of the property is $100,000, and it has a fair value of $150,000. Present value factors for a 10% interest rate are as follows:

-Refer to Exhibit 20-3. What is the amount of the annual lease payment Quinn would require round the answer to the nearest dollar) ?

A) $35,972

B) $39,570

C) $34,483

D) $37,931

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Which of the following items would not

Q39: Which of the following amortization policies is

Q40: Unlike in a direct-financing lease, the fair

Q41: On January 1, 2016, Denise Company signed

Q42: Which of the following cash flows is

Q45: On January 1, 2016, Watson Company signed

Q46: On January 1, 2016, Donna Company leased

Q47: For a sales-type lease, cost of asset

Q48: A required disclosure of a direct financing

Q49: Which of the following items should be