Multiple Choice

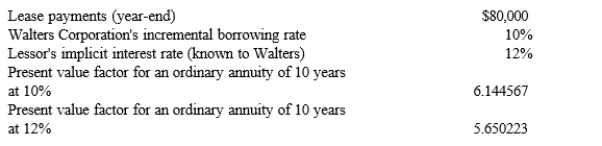

On January 3, 2016, the Walters Corporation signed a 10-year non-cancelable lease for manufacturing equipment. The fair value of the equipment at that time was $550,000. At the end of the lease period, the equipment, which has an estimated life of 15 years, will be returned to the lessor. Additional information is below:  Walters should

Walters should

A) capitalize the equipment at $550,000.

B) capitalize the equipment at $491,565.

C) capitalize the equipment at $452,018.

D) not capitalize the equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q81: Control over the underlying asset in a

Q82: For the lessor, cash receipts for a

Q83: On January 1, 2016, Stephen Corp., a

Q84: Alen Company, a lessor, signs a lease

Q85: Which of the following is a difference

Q87: Davis Co., a lessor, signed a direct

Q88: Greenway Company signs a six-year lease with

Q89: Which of the following facts would require

Q90: Exhibit 20-4<br>On January 1, 2016, Average Leasing

Q91: Exhibit 20-2<br>On January 1, 2016, Mary Company