Multiple Choice

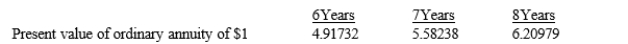

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

A) $8,571.43

B) $9,115.25

C) $10,139.72

D) $11,516.78

Correct Answer:

Verified

Correct Answer:

Verified

Q82: For the lessor, cash receipts for a

Q83: On January 1, 2016, Stephen Corp., a

Q84: Alen Company, a lessor, signs a lease

Q85: Which of the following is a difference

Q86: On January 3, 2016, the Walters Corporation

Q88: Greenway Company signs a six-year lease with

Q89: Which of the following facts would require

Q90: Exhibit 20-4<br>On January 1, 2016, Average Leasing

Q91: Exhibit 20-2<br>On January 1, 2016, Mary Company

Q92: Lease accounting rules may apply if an