Multiple Choice

During its first year of operations ending on December 31, 2016, the Dakota Company reported pretax accounting income of $600,000. The only difference between taxable income and accounting income was $80,000 of accrued warranty costs. These warranty costs are expected to be paid as follows:  Assuming an income tax rate of 30% in 2016, what amount of income tax expense should Dakota report on its 2016 income statement?

Assuming an income tax rate of 30% in 2016, what amount of income tax expense should Dakota report on its 2016 income statement?

A) $175,000

B) $180,000

C) $185,000

D) $204,000

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Describe the process for determining deferred tax

Q16: James Company reports the following information related

Q17: Bourne Company received rent in advance of

Q18: Beare Company claims a $2,000,000 R&D tax

Q19: An operating loss must be carried back

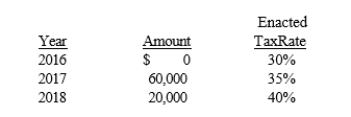

Q21: Pruett Corporation began operations in 2015 and

Q22: Assuming there are no prior period adjustments

Q23: The value of deferred tax assets and

Q24: Combining the net deferred tax asset and

Q25: At December 31, 2016, the Blue Agave