Essay

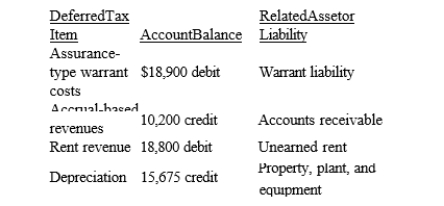

James Company reports the following information related to their deferred tax items at the end of 2017:  Required:

Required:

Show how the information would be reported on James's December 31, 2017, balance sheet.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Permanent differences arise due to timing differences

Q13: The value of deferred tax assets and

Q14: Thorn Corporation has deductible and taxable temporary

Q15: Describe the process for determining deferred tax

Q17: Bourne Company received rent in advance of

Q18: Beare Company claims a $2,000,000 R&D tax

Q19: An operating loss must be carried back

Q20: During its first year of operations ending

Q21: Pruett Corporation began operations in 2015 and

Q56: All of the following involve a temporary