Short Answer

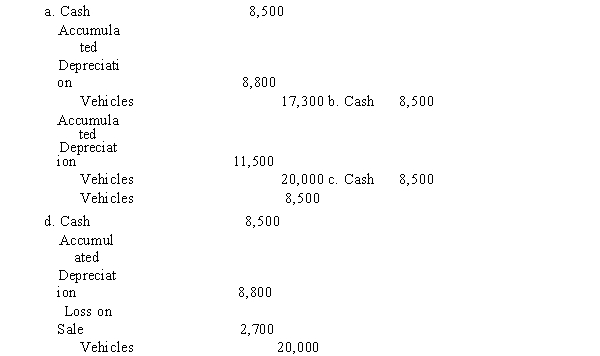

A company purchased ten delivery vehicles at a cost of $20,000 each and used the group depreciation method. Which of the following entries would be correct when recording the subsequent sale of a vehicle for $8,500 group accumulated depreciation is $88,000)?

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Property, plant, and equipment must be reviewed

Q99: On January 1, 2015, the Jones-Smith Corp.

Q100: Development costs incurred for purchasing equipment can

Q101: GAAP requires the general description of the

Q103: Under the MACRS principles, the tax life

Q105: Making intercompany comparisons is equally as important

Q106: The Sahara Company purchased equipment on January

Q107: The use of accelerated methods is appropriate

Q108: The depreciation base is computed as follows:<br>Estimated

Q109: The MACRS Depreciation table is as follows:<br>MACRS