Essay

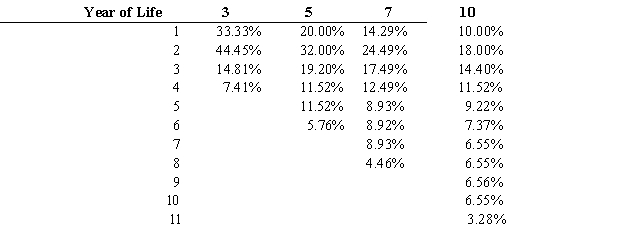

The MACRS Depreciation table is as follows:

MACRS Depreciation as a Percentage of the Cost of the Asset  Required:

Required:

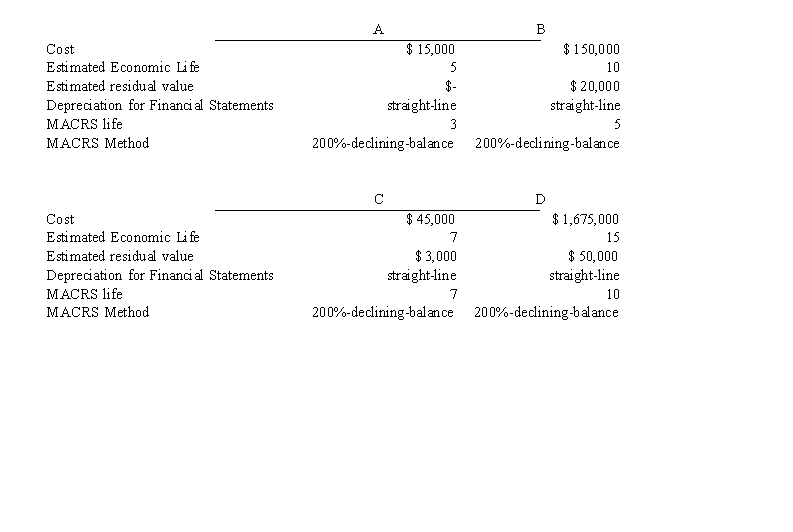

Using the MACRS Depreciation table calculate each year of depreciation for each independent situation.

Correct Answer:

Verified

Correct Answer:

Verified

Q104: A company purchased ten delivery vehicles at

Q105: Making intercompany comparisons is equally as important

Q106: The Sahara Company purchased equipment on January

Q107: The use of accelerated methods is appropriate

Q108: The depreciation base is computed as follows:<br>Estimated

Q110: Assets from time to time become impaired.

Q111: Which one of the following is not

Q112: When conducting an impairment test, a company

Q113: List the time based methods of cost

Q114: GAAP allows companies to choose between time-based,