Essay

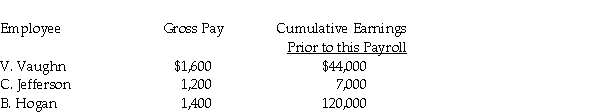

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The W-2 is the Wage and Tax

Q42: Mike's Door Service's payroll data for the

Q43: Record in the general journal the payroll

Q44: Sweeney's Recording Studio payroll records show the

Q45: Form SS-4 is:<br>A) completed to obtain an

Q47: An employer must always use a calendar

Q48: The employer's annual Federal Unemployment Tax Return

Q51: What liability account is reduced when the

Q57: Prepare the general journal entry to record

Q103: Prepare the general journal entry to record